2020 was the most remarkable year ever for real estate in the Tahoe Truckee region.

Accordingly, each shock event that transpired in 2020, from pandemic to wildfires to political and social unrest, created a distinct wave of demand from those for whom Tahoe offered sanctuary.

For most consumers, interest in acquiring mountain property had a sense of immediacy to it. As such, completed homes in new or updated conditions were among the hottest of commodities. For many, the sense of permanence necessitated different programming whether space or setting. This concept generated a wave of pre-sale activity that drove an already bustling new construction market to greater heights while doubling demand for vacant land year over year.

An enormous volume of media was dedicated to the market phenomenon over the last year including many prominent, national publications.

Forbes – Tahoe Real Estate blows past $2 billion

Forbes – Tahoe Up Residence in Truckee

NPR – Parts of America See Housing Boom During COVID-19

Wall Street Journal – Lake Tahoe, Not Just Vacation Homes Anymore

Bloomberg – Lake Tahoe Booms as Techies Work from Home

Tahoe Quarterly – Heading for the Hills

Bloomberg – Booming Zoom Towns

While easy to ascribe this tidal wave of demand to the pandemic, the seeds of this activity have been nurturing for quite some time. In the post-recession era, the Tahoe region, specifically newer resort communities around Truckee, have become a more permanent home to an increasing number of Bay Area emigrants who are untethered to a traditional office routine. Many have abandoned their San Francisco roots entirely while others have defied the traditional weekend travel pattern by finding a form of hybrid residency that keeps a foot in both the urban and mountain world.

This list of superlatives realized in 2020 is nothing short of astonishing:

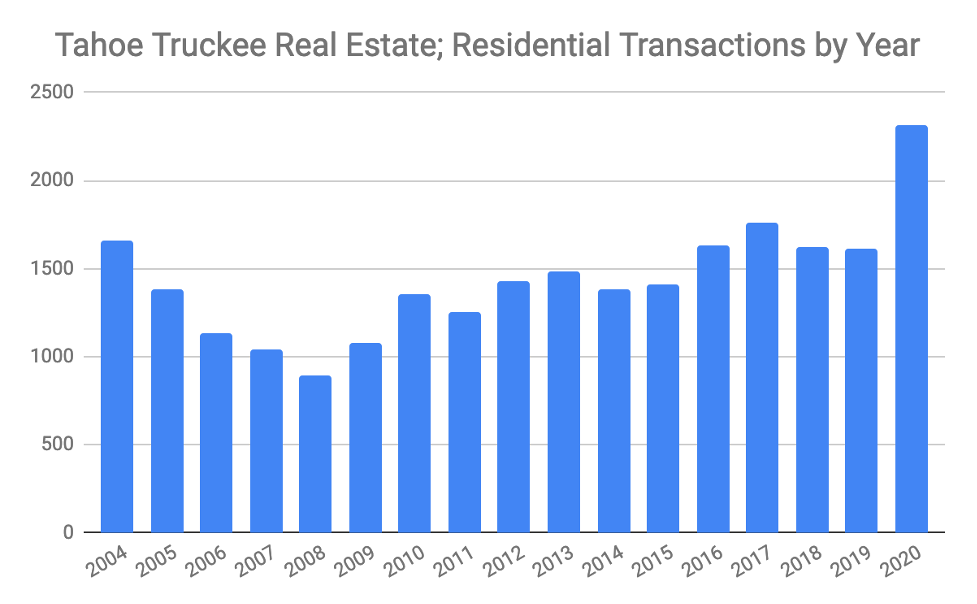

- 2350 total residential transactions. 33% higher than the previous benchmark of 1763 in 2017.

- $2.7 billion total dollar volume for residential sales. This is the first time the region has eclipsed $2 billion and represents a 79% increase over 2019.

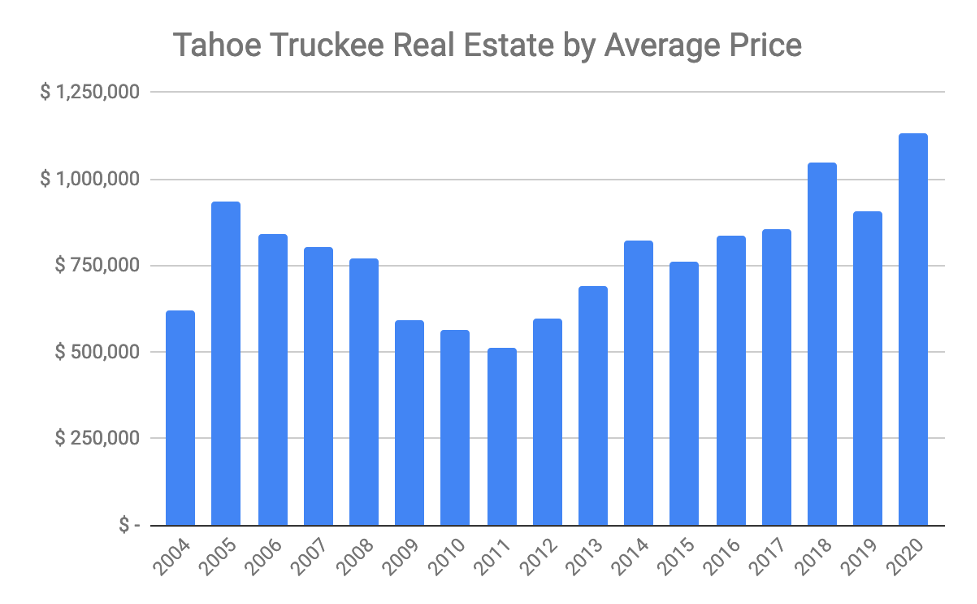

- Average price of $1,133,000 is a 25% year-over-year increase and only the second time the region has averaged greater than $1 million.

- Median price of $750,000 is 17% higher than 2019 and the highest ever recorded.

While demand has been spread across all price points, activity has been increasingly biased toward newer, amenitized communities that offer access to the active lifestyle pursuits that personify the region as well as modern architecture and built-in community programming and interaction.

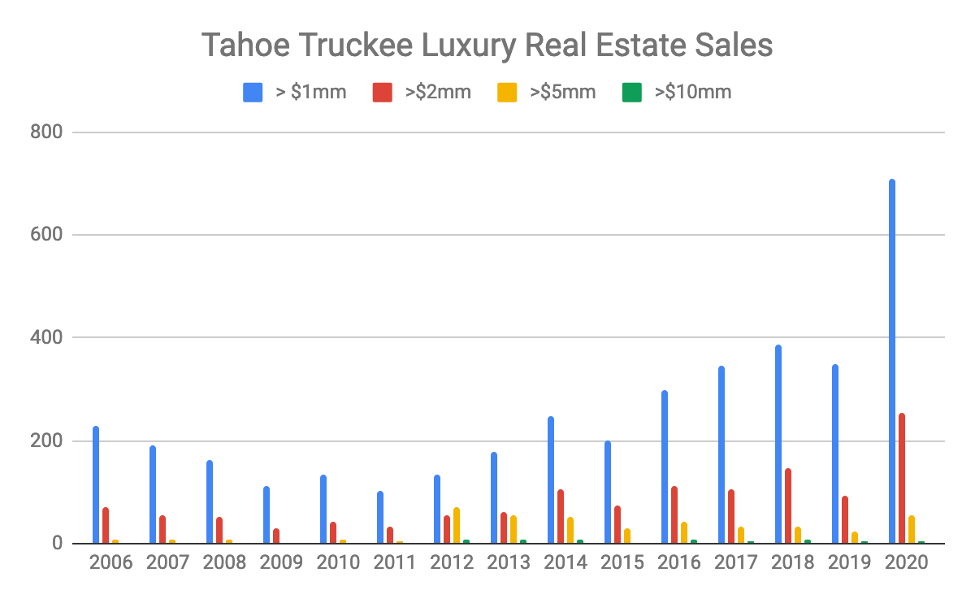

As a result, sales at prices greater than $1 million more than doubled year over year to a remarkable 710 transactions. Similarly, sales greater than $2 million improved from 94 in 2019 to 254 in 2020.

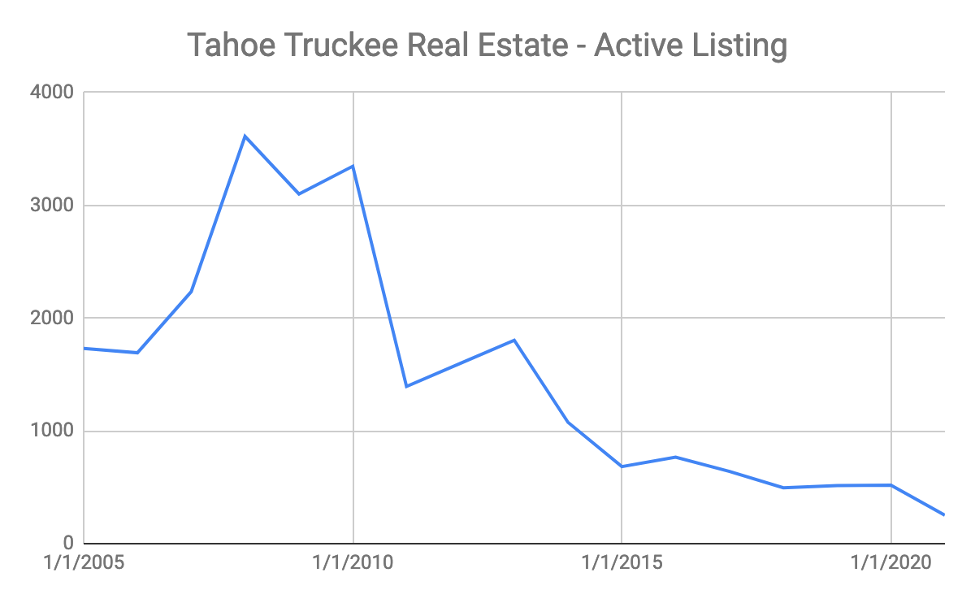

Results in all categories, including the super-premium where sales greater than $10 million held steady compared to the prior year, were constrained only by limited supply. Entering 2021, residential inventory stands at a meager 252 active listings, just 5 weeks’ supply: by far the lowest on record.

The trajectory of 2020 by any measure has been incredible. The frenzied buying and tight supply were stark reminders of the bubble times that preceded the 2008 recession. While memories remain long, there are some fundamental differences in the most recent year. Namely, consumers were not buying with an assumption of appreciation. Their wants were so much more immediate that many are assuming some level of depreciation in the immediate near term and have accepted this as the cost of the utility value provided by the home. As multiple offers drove prices well above asking in many cases, the questions being asked by consumers were less “what is it worth” and more “what is it going to take.” Correspondingly, an inordinate number of purchases were made with cash; often out of necessity to offer sellers maximum security and efficiency when being compared against competitive bids. In 2020, 35% of all transactions were made with cash. This compares to 15% at the market’s prior peak in 2006. Ultimately this reveals not only the urgency in today’s consumer but also the remarkable wealth to have the capacity for such a purchase without needing to liquidate a primary home in the Bay Area.

With demand unwavering and supply exhausted, it appears that 2021 will show little erosion of the gains made over the last year. While the world yearns for a return to normalcy, the revelation of the benefits inherent to a mountain lifestyle are likely to linger in a way that keeps Tahoe and Truckee on the forefront of consumers’ minds.